A Comprehensive Guide to Finding the Hawaii TMK (Tax Map Key)

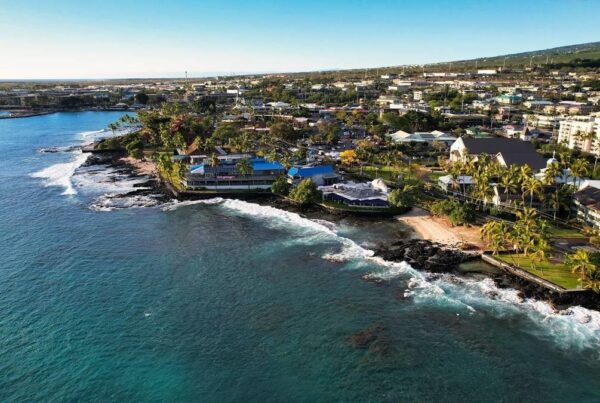

Are you navigating the intricate world of Hawaiian real estate in Kailua Kona and in need of guidance on how to locate the Tax Map Key (TMK) for a specific property?

Understanding the TMK system is crucial for property owners, real estate professionals, and anyone involved in land transactions in Hawaii. In this detailed blog post, we will dive deeper into the process of finding the Hawaii TMK and its significance in property dealings.

Understanding the TMK System

In Hawaii, the Tax Map Key (TMK) system serves as a vital tool for identifying and managing properties for tax assessment purposes. Each parcel of land is assigned a unique TMK number, comprising an island code, a district code, and a parcel number. The TMK number acts as a fundamental identifier for property taxation, assessment, and land ownership records throughout the state.

Steps to Find the Hawaii TMK

1. Go to the County of Hawaii – Real Property Tax Website: This website is a treasure trove of spatial data, including TMK information. Visit the portal’s website and explore the search functionality to locate the TMK of a specific property.

2. Search by Address or Parcel Number: Input the property address or parcel number into the search bar on the Hawaii Geospatial Data Portal to retrieve detailed information about the property, including its TMK number.

3. Reach Out to the County Assessor’s Office: If your online search proves fruitless, consider contacting the County Assessor’s Office in the county where the property is situated. The assessor’s office can assist you in obtaining the TMK number and other pertinent property details.

4. Consult with Real Estate Professionals: For additional support in finding the TMK for a property, seek guidance from local real estate professionals. Real estate agents and brokers possess tools and resources that can streamline the process of locating TMK numbers in Hawaii. Feel free to send me an email at maly@discoverthebigisland.com

Unveiling the Importance of the TMK

Understanding the significance of the TMK is essential for various aspects of property management and transactions in Hawaii:

– Property Taxation: The TMK plays a pivotal role in determining property taxes for individual land parcels.

– Property Assessment: Property assessments rely on the TMK to ascertain the value of properties for tax assessment purposes.

– Land Ownership Records: The TMK system is instrumental in maintaining accurate land ownership records and delineating property boundaries across Hawaii.

In conclusion, mastering the art of finding the Hawaii TMK is paramount for individuals navigating the real estate landscape in the Aloha State. By following the step-by-step guide provided in this blog post, you can effortlessly uncover the TMK for any property in Hawaii and gain access to crucial information concerning land ownership and taxation.

How to Input the TMK Number in the county website

To input a TMK Number, follow the 9-digit format without special characters:

I-Z-S-PPP-ppp

Where:

I = Island Number (1 digit)

Z = Zone Number (1 digit)

S = Section Number (1 digit)

PPP = Plat Number (3 digits)

ppp = Parcel Number (3 digits)

Island Number

1 = Honolulu

2 = Maui

3 = Hawaii

4 = Kauai

Remember to add zeros to the Plat or Parcel number if they are less than 3 digits.

Examples:

1. For Parcel Number 3-9-2-118:43, input as 392118043

(Add a leading zero to the parcel number)

2. For Parcel Number 3-7-5-20:73, input as 375020073

(Add leading zeros to both the plat and parcel numbers)

Embrace the TMK system as a cornerstone of property transactions and land management in Hawaii, ensuring that you are well-equipped to navigate the complexities of real estate dealings with confidence and clarity.