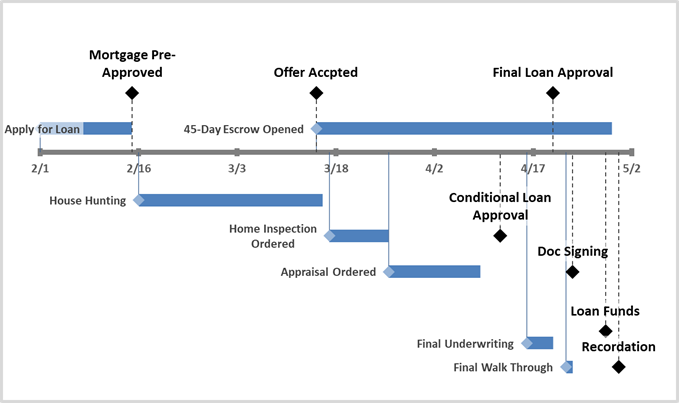

- Mortgage Pre Approval

- Closing Date

- Conditional Loan Approval (CLA) Date

- Final Loan Approval (FLA)

- Document Signing and Final Walk Through

Mortgage Pre Approval

Obtaining mortgage pre-approval doesn’t have to be an extensive process. With the right documents, you can get a pre-approval within 24 hours! Most applicants need some time to collect items like pay stubs and bank statements for their application — but don’t let this slow down your progress.

Make sure that two weeks is allotted so you’re fully prepared when it’s time to start the journey towards homeownership – we’ll help speed up every step of the way!

Look deep into nature, and then you will understand everything better.

Closing on a house in thirty days is possible, but it can depend on many factors. The appraisal process may take longer if the property is located remotely or overseas; additionally, some lenders work faster than others and that must be taken into consideration when submitting an offer to purchase.

Ultimately, having a discussion prior to any form of agreement will prove beneficial for all parties involved as the timeline works towards closing within 45 days – with potential room for negotiation!

Conditional Loan Approval (CLA) Date

If the contract states the appraisal cannot be a condition listed on the Conditional Loan Approval that the loan officer issues, that date must be moved further down the timeline. If you move forward with inspections, lets say in 5 days, then you can start ordering the appraisal. If you delay ordering the appraisal for about 2 weeks after the contract is accepted, the earliest the loan officer can issue a CLA is a month into the transaction. That’s just 15 days prior to closing.

Generally speaking, it’s best practice for most underwriters that they’d only review a loan file twice: first at its inception and then one last time before full approval.

Final Loan Approval (FLA):

After weeks of hard work and careful gathering, all the conditions outlined by an underwriter are met during Final Loan Approval. This is when a file will be sent to Closing Department for final figures to be calculated – this involves more than just appraising!

Even the all-powerful Pointing has no control about the blind texts it is an almost unorthographic life One day however a small line of blind text by the name of Lorem Ipsum decided to leave for the far World of Grammar. The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question Marks and devious Semikoli.

Document Signing & Final Walk Through:

The rule of thumb is to complete your final walk through then drive over to the Escrow Company and sign your documents for closing. If the walk-through had to be pushed back because the work promised wasn’t completed, you can still sign. If the new date for Final Walkthrough comes around and there are still issues, the lender can put a stop to everything until we resolve it.

Make sure that two weeks is allotted so you’re fully prepared when it’s time to start the journey towards homeownership – we’ll help speed up every step of the way!